The dream of great wealth drives millions of people to the stock market every day. Everyone expects big profits from their investments; above all, most individuals expect to achieve high returns by holding onto their investments for long enough. The majority of exchange participants, however, ignore that it is possible to incur losses with this strategy. Only a small minority of stock market participants inform themselves rigorously about their investments before making a decision. Moreover, within this group of individuals, only a small subset independently researches off the beaten track of the usual quarterly figures and the consensus about the market outlook. We can therefore conclude that only a small minority of investors devote the necessary attention to their investments and brings necessary professionalism to it. The decision of participating in the stock market with their capital is ultimately based on pure instinct and thus emotional. Over the years, we have also observed that not only private investors operate in this manner, but also a significant part of professional managers.

Two basic emotions drive investor behavior: greed and fear. Greed attracts investors and speculators to the stock markets, thereby increasing prices. Conversely, fear leads to price decreases.

A special group of investors has always attempted to capitalise on greed and fear. This strategy is known as "contrarian investing", as these investors act against the dominating trend. When they believe that the market is about to turn, they preemptively position themselves against the imminent movement. The best tools for the timely capture of these trends are appropriate sentiment indicators.

Based on these inputs, the mastermind behind ONE SIGNAL developed a non-discretionary system, which uses sentiment indicators to apply the approach of "contrarian investing". ONE SIGNAL follows the aim of recognizing extreme situations and reactions (e.g. exaggerated fear or greed) in every phase of the market. ONE SIGNAL therefore identifies sentiment trends and follows them until the overreaction phase (market bubbles), to then strategically change direction. This makes ONE SIGNAL the smarter trading tool.

“There are 1000 ways to get rid of money, but only 2 ways to get it - either we work for money or the money works for us.”

CEO & Founder of CaRisMa Inforservice GmbH

The mastermind behind ONE SIGNAL is Ara Yalmanian a passionate and experienced investment pioneer from Vienna. Ara has decades of experience in the implementation of trading signals, based on sentiment indicators, in daily trading on the stock exchange. Born as an Armenian in Damascus in 1963, Ara moved to Austria in 1982. He graduated with a MSc in Banking & Finance. He started his career at MAIL Wealth Management and at Hasenbichler Asset Management. He is fluent in German, English, Arabic and Armenian. Already enthusiastic about markets and stock market psychology since his studies, Ara Yalmanian began developing a system almost 20 years ago that generates trading signals based on emotional principles, so-called sentiment indicators. Over the past decades, he has been continually refining the system. His philosophical-psychological approach, together with two decades of stock market experience, makes Ara an expert in targeted and extremely profit-oriented trading that combines the knowledge of business and neuroscience. Yalmanian's extremely analytically oriented approach to ONE SIGNAL is based on Contrarian Investing and describes an anti-cyclical investment strategy.

Head of Growth

After graduating from Lycee Francais de Vienne, she pursued her higher education at the University of Warwick (with a semester at the University of St. Gallen). Clara graduated with a BSc. (Hons) International Management in 2019. Her experiences range from corporate finance at Clipperton Finance, to Sales & Trading at UBS as well as Société Générale and Investment Banking at Rothschild & co. Clara also worked at Amundi in Private Debt (Leveraged Loans) for one year. After her time at Amundi, she decided to pursue her career at ONE SIGNAL, to grow the family business in London. Clara is fluent in German, French, English and Armenian.

The dream of great wealth drives millions of people to the stock market every day. Everyone expects big profits from their investments; above all, most individuals expect to achieve high returns by holding onto their investments for long enough. The majority of exchange participants, however, ignore that it is possible to incur losses with this strategy. Only a small minority of stock market participants inform themselves rigorously about their investments before making a decision. Moreover, within this group of individuals, only a small subset independently researches off the beaten track of the usual quarterly figures and the consensus about the market outlook. We can therefore conclude that only a small minority of investors devote the necessary attention to their investments and brings necessary professionalism to it. The decision of participating in the stock market with their capital is ultimately based on pure instinct and thus emotional. Over the years, we have also observed that not only private investors operate in this manner, but also a significant part of professional managers.

Two basic emotions drive investor behavior: greed and fear. Greed attracts investors and speculators to the stock markets, thereby increasing prices. Conversely, fear leads to price decreases.

A special group of investors has always attempted to capitalise on greed and fear. This strategy is known as "contrarian investing", as these investors act against the dominating trend. When they believe that the market is about to turn, they preemptively position themselves against the imminent movement. The best tools for the timely capture of these trends are appropriate sentiment indicators.

Based on these inputs, the mastermind behind ONE SIGNAL developed a non-discretionary system, which uses sentiment indicators to apply the approach of "contrarian investing". ONE SIGNAL follows the aim of recognizing extreme situations and reactions (e.g. exaggerated fear or greed) in every phase of the market. ONE SIGNAL therefore identifies sentiment trends and follows them until the overreaction phase (market bubbles), to then strategically change direction. This makes ONE SIGNAL the smarter trading tool.

“There are 1000 ways to get rid of money, but only 2 ways to get it - either we work for money or the money works for us.”

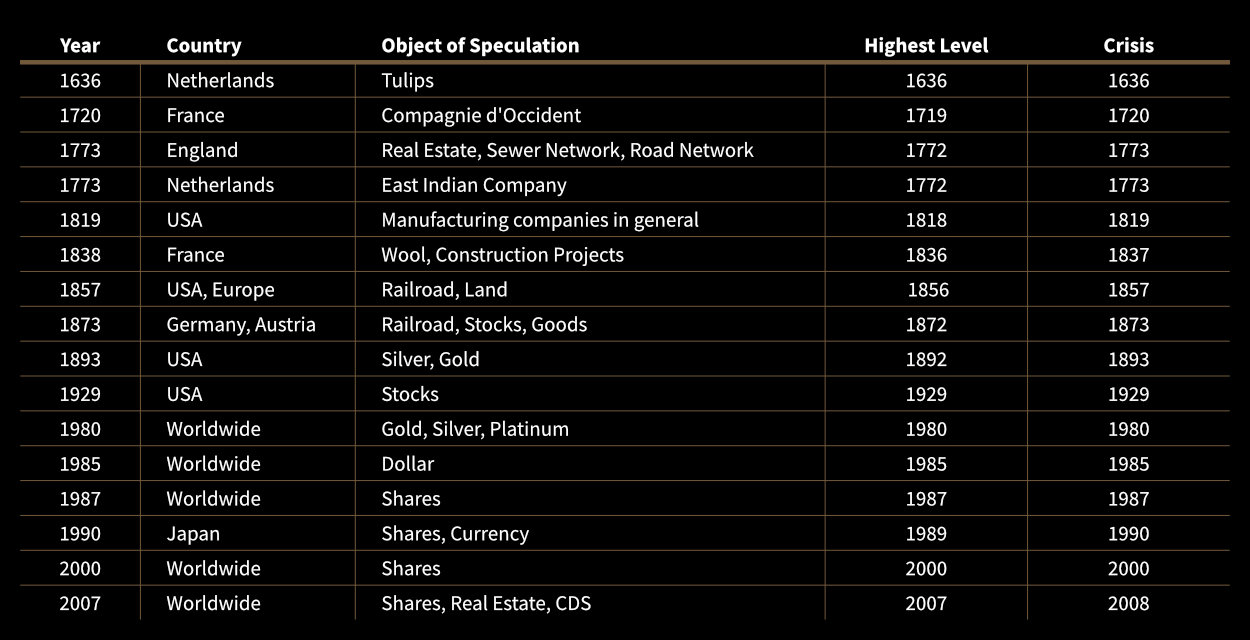

This table represents the historical highs of various speculation instruments worldwide of a time period of 400 years. It demonstrates very clearly that bear markets always followed historical highs. These downward trends were caused market participants’ by the fear of loss, which led them to sell their instruments and therefore cause the bear markets.

ONE SIGNAL’s strategy is based on “Contrarian Investing”, which entails countercyclical behaviour to most exchange participants. Consistent use of ONE SIGNAL’s information therefore enables to successfully bet against the (emotionally) misdirected majority without any emotional missteps.

ONE SIGNAL is based on the following sentiment indicators, among others: VIX - volatility index for the S&P 500, PC - put-call ratios and open interest. The levels of these indicators are fed into the system on a daily basis. Several systems with different approaches and perspectives each calculate a signal. Ultimately, ONE SIGNAL works with several signals obtained in this way; these are checked for their validity in the historical context and for their performance patterns and weighted according to the probability of occurrence. The weights of the long and short signals are compared and this determines a final signal for the next trading day.