January Impact

In some circles, there is a widespread opinion that the US stock markets’ annual development can already be predicted after the first month of the year. We examined this assumption and summarized our findings below.

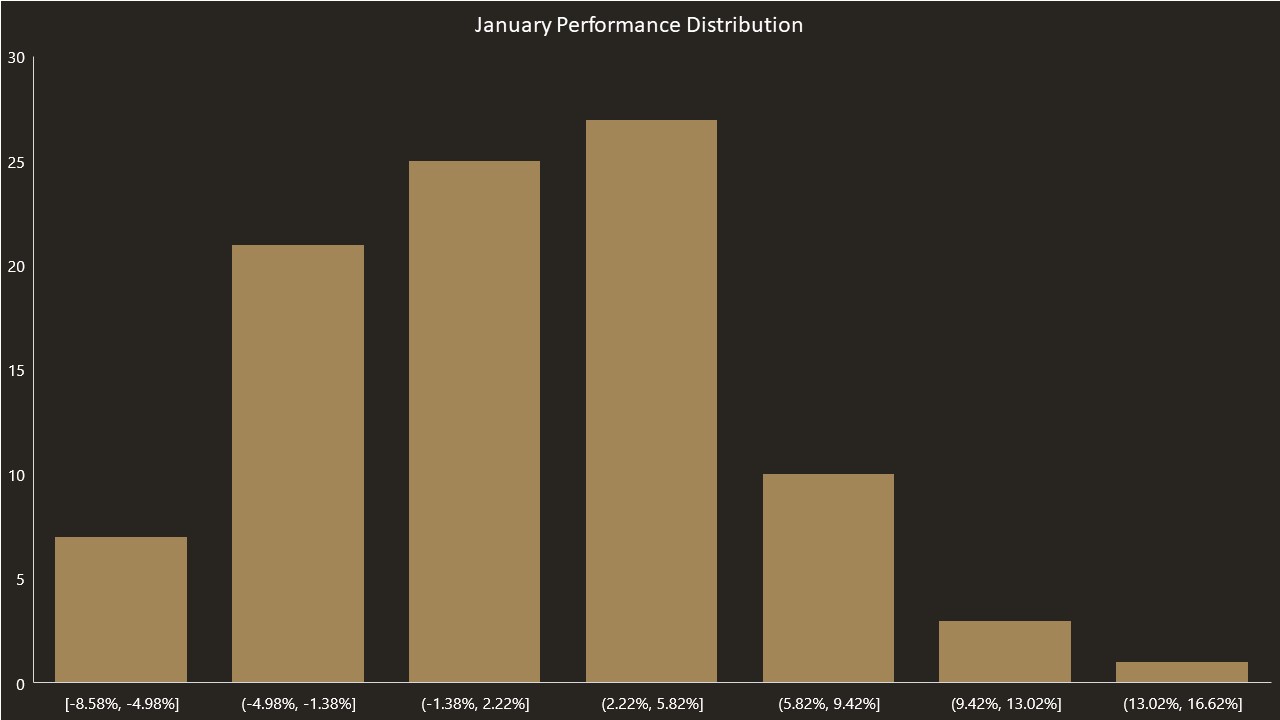

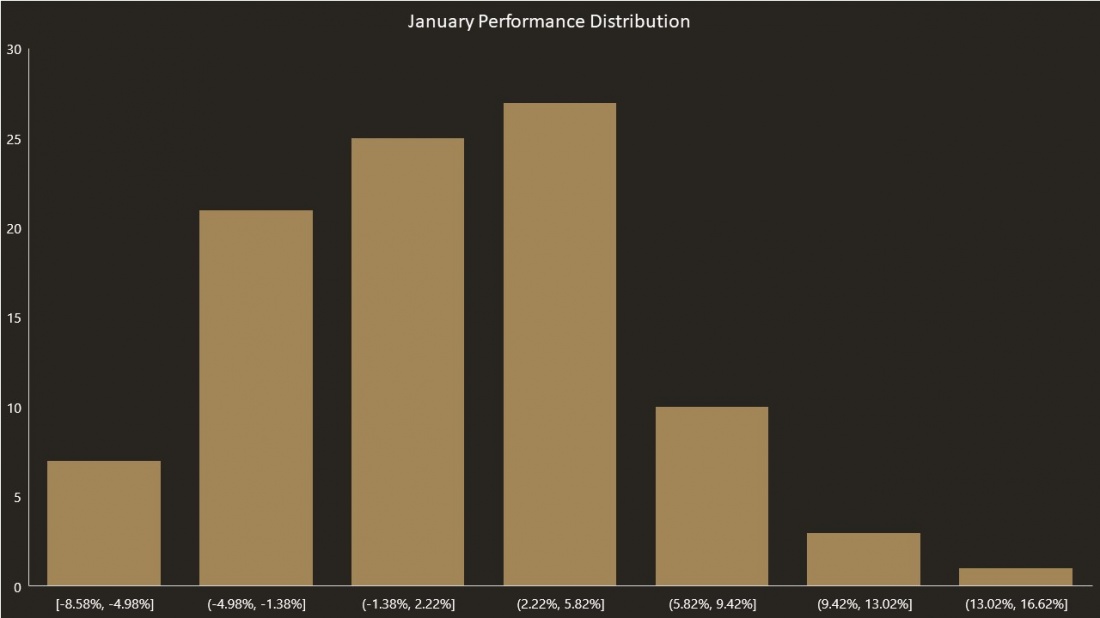

We calculated the performance of the month of January for every year since 1950 as well as the respective year’s general performance and subsequently compared the two figures.

The table above shows that as the period under observation becomes shorter and closer to us, the less influential the month of January is on the general performance of a given year. Furthermore, a positive January equally loses its influence under such conditions. It can only be speculated about the reasons behind this phenomenon, and every explanation probably has its merits. Yet, it is striking that during the period of 1950-2020, a year following a positive January was also positive in 88.00% of cases. Even though this percentage receded to 70.00% between 2000 and 2020, this is still remarkable.

However, January 2021 has bestowed a negative month upon us. We will thus examine to what extent we have to bear this in mind for our further calculations regarding this year. Between 2000 and 2020, around 64.00% of years ended positively following a negative January. The average yield was 2.72%, the highest was 26.38% (2003) and the lowest was at -38.47% (2008).

The Start into the New Year and its Consequences Since January is a rather long month with its 31 days and it is preferable to have certainty from early on, many market observers regard January’s performance as an indicator for later developments on the stock market. We will now examine this further:

As we can see, it is not an irrational assumption that a year’s first five days are can be an indicator of the performance of the remainder of the year. Since 2000, the first 5 days closed in the green fourteen times. In ten cases (71.43%), the S&P500 ended with an average positive performance of 11.59%, with a maximum and minimum yield of 30.43% (2019) and -23.37% (2002) respectively. However, if the first five days closed in the red, the rest of the year was positive only four out of seven times (57.14%). Even though we cannot speak of statistical significance here, there seems to be a certain correlation. For the period between 1950 and 2020, we calculated a positive start into the new year in 43 cases; out of those, 79.07% ended the year positively, with the average annual performance being 12.40%. In contrast, the 28 times the year started on a negative note, the average yield of the remainder of the year was 4.30%. This compares with the period’s average annual yield of 6.00% for the S&P500. Following the signals of the year’s first five days, one would have quadrupled the initial amount of the investment over the last 20 years. During the same time period, a Buy-and-Hold investor would have increased the amount he had invested by two and a half times. We only consider gross profits and do no take taxes or other costs into account. We would also like to point out that these computations only refer to the past and do not represent investment advice.

The Santa Claus Rally and its Persistent Euphoria… Often, people suggest going far back in one’s calendar in order to examine the so-called Santa Claus Rally and its impact on the following year. We followed this advice and obtained the following results:

By juxtaposing table 2 and table 3, it becomes evident that the results are remarkably similar.

So far, we have examined three ways to estimate the further development of the year or, in the third case, even the evolution of the following one. We thereby concluded that all three methods work well at doing so.

Yet, it would also be interesting to gauge how the three methods work in combination with each other and to what extent they have enabled investors to make investment decisions in the past.

Fusion As already mentioned, we would like to combine the three methods and examine their effectiveness in the past. Having three variables (Santa Claus Rally, First Five Days und January effect) that can take on either positive or negative values respectively, we can construct eight scenarios that occurred with different frequencies in the past. The following two tables illustrate these eight different scenarios and their results. We would like to point out that this does not allow us to make inferences about future events. For reasons of space, we allocated a plus sign to a positive period and a minus sign to a negative period. The signs’ order is chronological: Santa Claus Rally, First Five Days, January Effect.

We would now like to describe the following three combinations in more detail as they appear, partly due to their actuality, to be the most interesting ones.

„+ + +“ offered the best market perspective. During all the periods under consideration, the yields were disproportionately high.

„- + -„ is one of the rarest scenarios investors had to deal with in the past. The yields were among the lowest of all periods.

„+ + -„ was chosen due to its actuality. This combination occurred this year (2020/2021). It seems interesting to us that the share of positive years increased when the respective periods were shortened.

One should not make inferences from these tables. There is no such thing as the perfect investment strategy. Every investment decision involves some sort of speculation, which will not necessarily be rewarded.

Appreciation:

In this paper, we have dealt with a strategy which Yale Hirsch, a passionate observer of the markets, had already presented in 1972. We took the broad features of his ideas, applied our own perspective to them and chose a separate calculation method, which led to slightly different results.

Data Sourcs: finance.yahoo.com